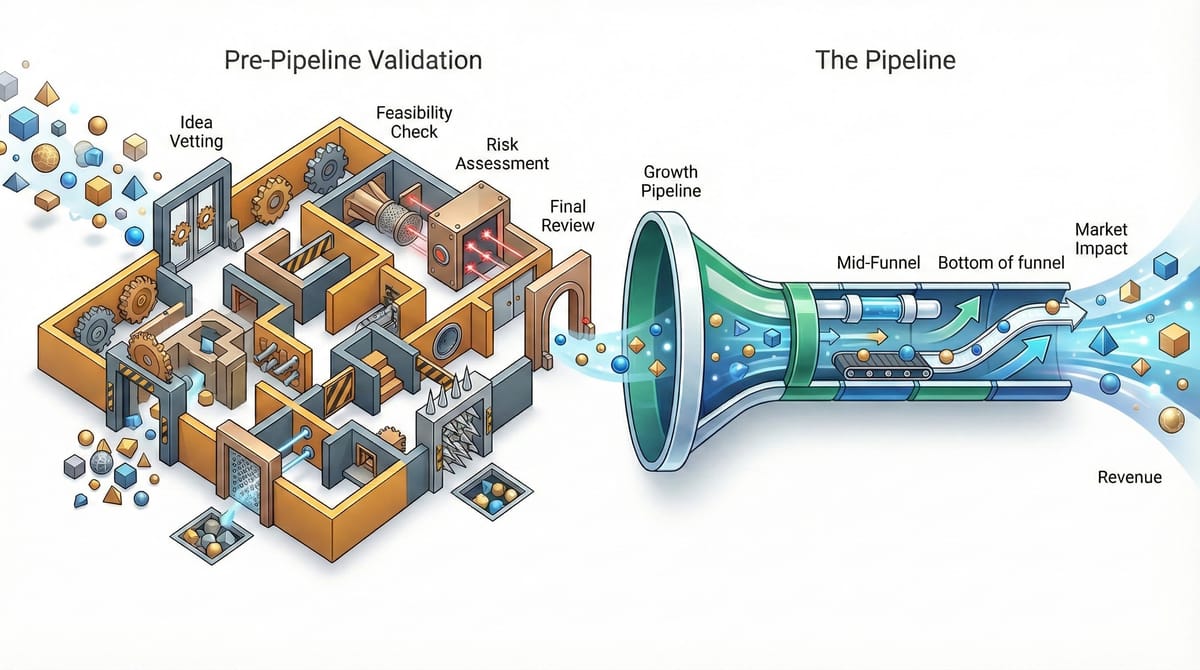

Pipeline weak? Re-validate the "pre-pipeline" gauntlet

To: Founders, CEOs, and GTM Leaders

Date: January 2026

Subject: The Growth Paradox in the Post-Hype Era

We are three years into the generative AI boom. 2026 is kicking off. Pipeline generation is on everybody's minds. But the "Gold Rush" phase is officially over. The capital is still here—over $44 billion deployed into our sector in the first half of last year alone—but for many of us, the pipeline isn't.

On the surface, our dashboard looks healthy: we have a product that works, a technical team that ships daily, and we are operating in a market that the press insists is "white hot." Yet, deeper metrics tell a different story. Our pipeline is flatlining. Our sales cycles are elongating from weeks to months. And most dangerously, churn is quietly eating our growth from the bottom up, masking any top-line gains.

The natural instinct for a CEO in this position is to treat it as a sales problem. We swap the VP of Sales. We double the paid acquisition budget. We demand more cold outbound (that's a different story for another day.)

Act, don’t react.

Most likely, the problem isn't in the pipeline. It is a Pre-Pipeline Blocker. You are likely suffering from a structural disconnect between your foundation and the market reality of 2026. The market has matured, but our go-to-market strategy is still partying like it’s 2023.

Here is the executive diagnostic to determine if we are building a scalable business or just a very expensive hobby.

1. The Founder Diagnostic: Do You Have "Earned Secrets"?

In a market moving this fast, "Founder-Market Fit" is not a cliché; it is our only durable moat.

Steve Blank taught us years ago that the only proxy for future success in the absence of metrics is "earned secrets." But in the AI era, we must distinguish between earned secrets and borrowed insights.

Are we building this company because we read a Gartner report that said "AI Legal Tech" is growing (borrowed insight)? Or are we building it because we spent ten years as a paralegal, drowning in discovery documents, hating our lives, and realizing exactly which 15 minutes of our day were the most painful?

The "Friday Lunch" Test

Are we willing to have lunch with a representative of your target customer every Friday for the next five years?

If you are building for construction managers, do we actually like construction managers? Do we understand their lexicon, their stress triggers, and their political constraints?

- The Tourist: Says "No," they just want to build the tech and exit. Tourists build wrappers—thin interfaces over commodity models. They are currently being wiped out by incumbents like Microsoft and Salesforce who can "wrap" better and cheaper than they can.

- The Resident: Says "Yes." Residents build solutions. They obsess over the workflow, not the model.

In 2026, the tourists are dead. If we don't love the problem more than the technology, we will pivot yourself to exhaustion before we ever find product-market fit.

2. The Market Trap: Beware the "False Positive"

The most dangerous thing in a hot market is early traction. It lies to you.

NFX calls this the "False Positive" trap. In 2024 and 2025, we probably got 10,000 signups because your tool was novel. It felt like success. But those weren't customers; they were sightseers. They were "snacking" on AI—trying it out for a laugh or a quick demo—not "eating" it as a core part of their daily nutrition.

Now that the novelty has worn off, we are seeing the brutal difference between "Vitamins" and "Chemotherapy."

- Vitamins (Nice-to-Have): These tools optimize a process. They make you 10% faster. In a recessionary environment or budget crunch, these are the first line items cut. If you hear, "We'll circle back next quarter," you are selling vitamins.

- Chemotherapy (Must-Have): These solve an existential pain. They keep the CEO out of jail (compliance) or keep the lights on (revenue) or stop the bleeding (EBITDA).

The "Bucket of Dirt" Reality:

If the customer's hair is truly on fire, they will buy a bucket of dirt to put it out. They won't care about your UI polish, your logo, or your dark mode. If they are demanding perfection before purchasing, the pain isn't real. Stop looking for more leads and start looking for a segment where the fire is actually burning.

3. The Economics: The "Compute Tax" is Killing Your Margins

We need to have a serious conversation about unit economics, because AI has fundamentally broken the SaaS business model.

Many of us are still pricing like it’s 2020. We expect 80% gross margins and infinite scalability. But AI introduces a "Compute Tax." Every time a user engages with our product, we pay a toll—an inference cost to OpenAI, Google, or AWS.

If we charge a flat monthly fee ($30/seat) but have variable costs per interaction, our incentives are misaligned. Our "power users"—the ones who love us most—are actually our worst financial enemies. I’m seeing AI "wrappers" with 50% gross margins trying to scale like software companies. That is a death spiral.

The Fix: "Service-as-Software"

The solution is to stop selling the tool (SaaS) and start selling the outcome ("Service-as-Software").

- Old Model (SaaS): Sell a tool to a human. The human does the work. You charge for the seat.

- New Model (SaS): Sell the result. The AI does the work. You charge for the outcome.

Example:

Don't charge $50/month for an AI agent that helps a recruiter write emails. Charge $1,000/month for "Qualified Candidates in the Inbox."

If you automate a $5,000/month job, you capture the margin. This aligns your incentives perfectly: the better your tech gets, the higher your margins go, because you need less human oversight to deliver the same result.

4. The Offer: Sell the Vacation, Not the Flight

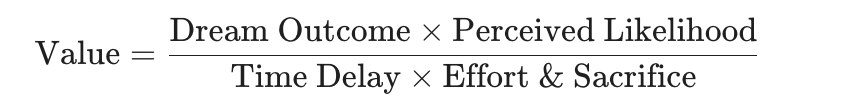

Alex Hormozi’s "Value Equation" is critical here. It explains why customers buy (or don't buy).

Most AI startups are failing the denominator (Time and Effort).

We pitch a "revolutionary AI platform," but then we ask the user to:

- Learn prompt engineering (High Effort).

- Integrate five different APIs (High Effort).

- Change their daily workflow (High Sacrifice).

- Wait 3 months for the machine learning model to "train" on their data (High Time Delay).

Is it any wonder they don’t sign?

The Pivot:

We must radically reduce the denominator.

- Outcome: Don't sell "AI writing assistant." Sell "Compliance Audit Done in 5 Minutes."

- Time To Value: It needs to be near zero. If they don't have an "Aha!" moment in the first session, they are gone.

Use the MED Protocol (Minimum Effective Dose): What is the smallest amount of interaction required to give the customer a huge win? Strip away every feature that doesn't directly reduce time-to-value.

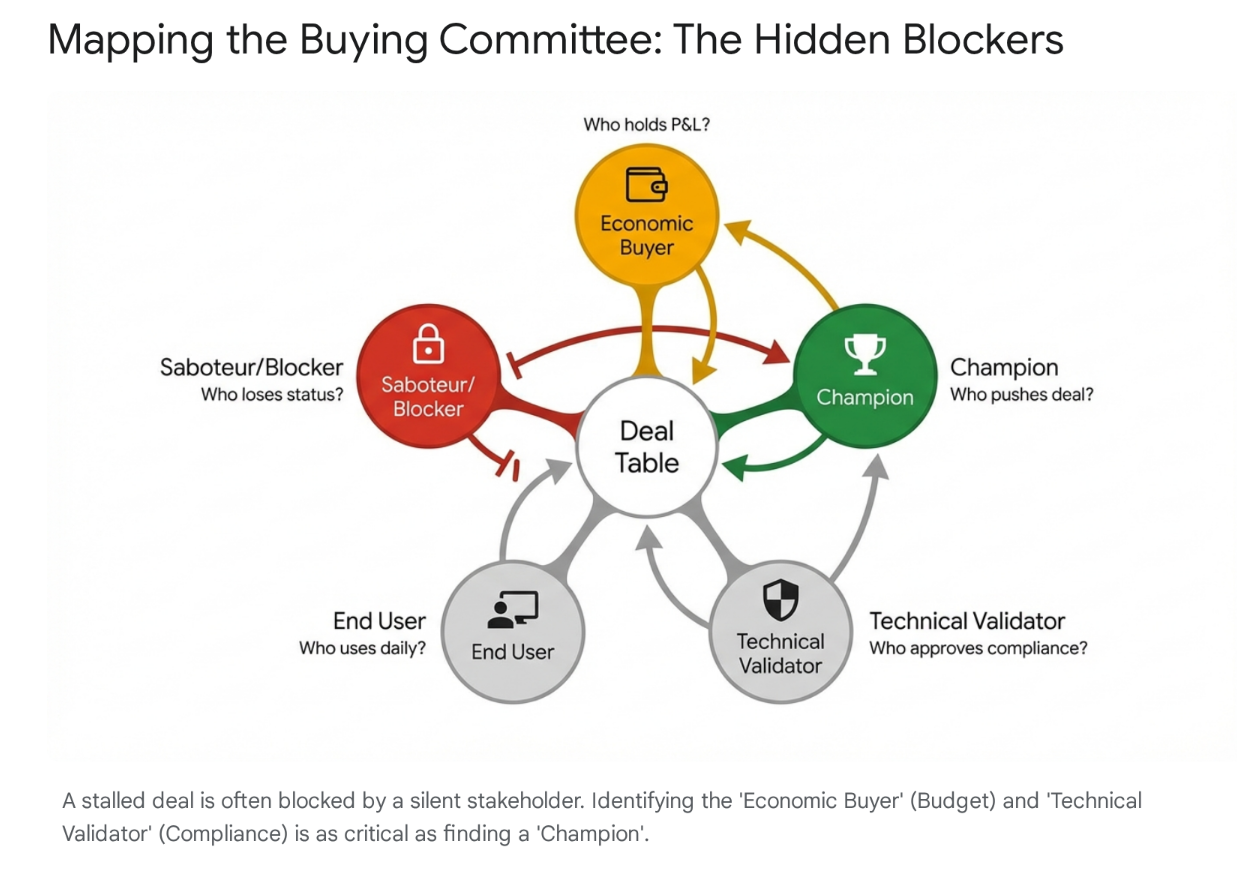

5. Execution: The "Hidden Committee"

Finally, if our product is right, and our economics are sound, but deals are still stalling, we are hitting the "Hidden Blockers."

In the enterprise of 2026, we are never selling to one person. We are fighting a complex Buying Committee, each with veto power and distinct anxieties.

- The Economic Buyer (CFO): Cares only about ROI and CapEx. They don't care about "innovation." They want to know if this replaces headcount or increases yield.

- The Technical Validator (CISO/IT): Cares about risk. "Where does the data go?" "Is it SOC2 compliant?" "Are you training on our IP?"

- The End User: Cares about survival. "Will this AI take my job?"

The Full Funnel Failure

As Andrei Zinkevich’s Full Funnel methodology reminds us, you cannot use a generic pitch deck for all three.

Deals stall indefinitely because founders are pitching "vision" to a CISO who only wants "safety." If we don't have a specific asset for the CISO (e.g., a Security One-Pager) and a specific ROI calculator for the CFO, our deal dies in the inbox.

Action: Map your accounts. Identify the committee. Create specific "kill sheets" for each stakeholder’s objections. Stop targeting companies that can buy (firmographics) and start targeting companies that need to buy (first-party intent signals).

Here is a summary of the questions to ask:

Phase 1: Founder & Psychology (The "Who")

| Diagnostic Question | Desired Answer | Red Flag (Blocker) |

| Are you building this because of specific "earned secrets" or general market hype? | Earned Secrets (Deep Industry Insight). | General Hype ("AI is the future"). |

| Can you survive 4+ years of "the grind" if the AI hype cycle crashes? | Yes, I love the problem. | No, I'm here for the exit. |

| Are you willing to have lunch with a customer every Friday? | Yes, I crave feedback. | No, I prefer coding/product. |

| Do you have a "Technical Reality" view of your moat? | Yes, our moat is workflow/data, not the LLM. | We have a "better prompt" strategy. |

Phase 2: Market & Problem (The "What")

| Diagnostic Question | Desired Answer | Red Flag (Blocker) |

| Is the problem a "Hair on Fire" (Level 10) issue? | Yes, it threatens revenue/compliance. | No, it's an efficiency "nice-to-have." |

| Do customers have an existing "workaround"? | Yes, they use spreadsheets/manual hacks. | No, they just ignore the problem. |

| Are early users "Tourists" or "Residents"? | Residents (daily usage, workflow integration). | Tourists (high churn after 30 days). |

| Have you validated the "False Positive" risk? | Yes, we focus on retention, not just sign-ups. | No, we celebrate every free trial. |

| Has the customer allocated budget? | Yes, line item exists. | No, we need to create the budget. |

Phase 3: Offer & Economics (The "How Much")

| Diagnostic Question | Desired Answer | Red Flag (Blocker) |

| Does the Value Equation balance? | High Outcome / Low Effort. | Low Outcome / High Learning Curve. |

| Are Unit Economics positive after AI inference costs? | Yes, we price for variable usage. | No, heavy users kill our margin. |

| Do you offer a "Grand Slam Guarantee"? | Yes, risk reversal is in place. | No, standard "contact sales" friction. |

| Is the "Time to Value" under 15 minutes? | Yes, immediate gratification. | No, requires weeks of setup. |

| Is the pricing complexity low? | Yes, simple tiers or outcome-based. | No, complex token-based math. |

Phase 4: Pipeline & Execution (The "How")

| Diagnostic Question | Desired Answer | Red Flag (Blocker) |

| Have you identified the Economic Buyer? | Yes, we know who holds the P&L. | No, we only talk to users. |

| Does the Homepage pass the 5-Second Test? | Yes, value is instant. | No, "buzzword soup" (e.g., "AI-enabled synergy"). |

| Are you targeting "Companies that Need" or "Companies that Can"? | Need (Situational Triggers). | Can (Firmographics only). |

| Is the "Hidden Blocker" (e.g., Legal/IT) mapped? | Yes, we have sales assets for them. | No, we hope they don't notice. |

| Is the Message-Market fit validated? | Yes, via Wynter or interviews. | No, we are A/B testing live traffic blindly. |

The Verdict

If growth has stalled, don’t reflexively blame the sales team. The 911 call may be coming from inside the house.

We may be trying to scale a process that is fundamentally broken at the pre-pipeline level.

- Check your conviction: Are you a Resident or a Tourist?

- Check your market: Are you selling Vitamins or Chemotherapy?

- Check your model: Are you pricing for seats or outcomes?

- Check your offer: Is the time-to-value near zero?

Go back to the foundation. Validate the pain. Fix the unit economics. Tighten the offer.

Be honest, if you run through the checklist, did you find any gaps?

Troy