The Architecture of Unfair Advantage: Global Frameworks for Assessing Founder-Market Fit and Domain Dominance

I’ve been spending a lot of time lately looking at why some startups struggle to get traction while others seem to just "click," even in difficult markets. We all obsess over Product-Market Fit (PMF)—and rightly so—but I’m seeing more evidence that we might be skipping a crucial first step.

Before the product fits the market, the founder has to fit the market.

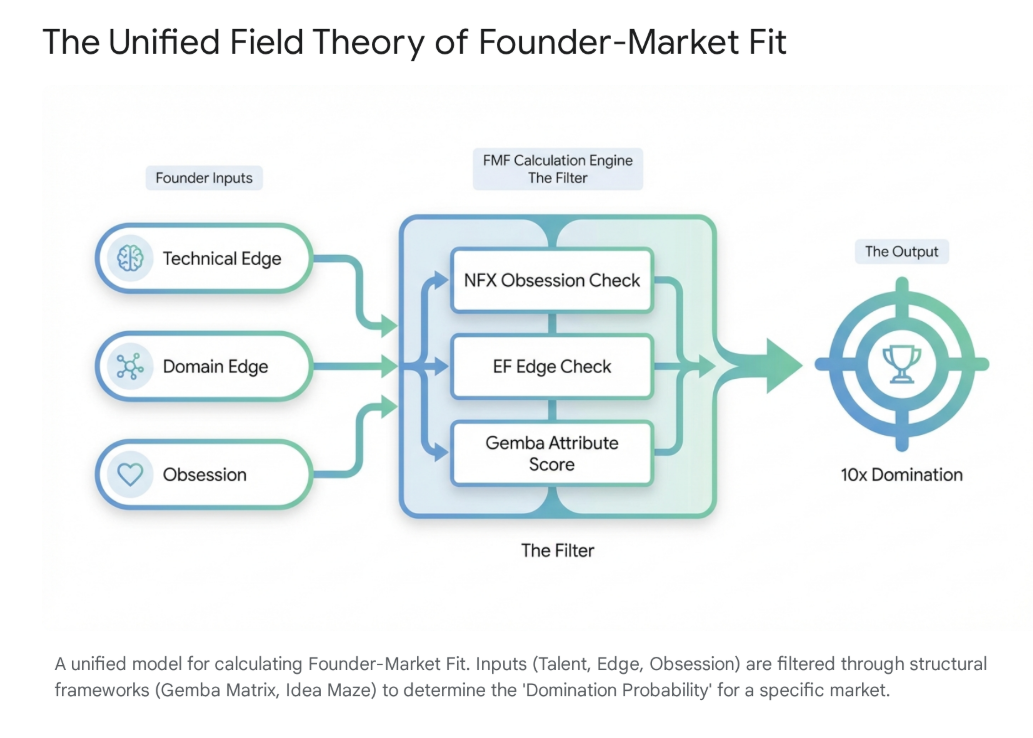

This is called Founder-Market Fit (FMF) and it’s about structural advantage. It’s the difference between fighting an uphill battle and having a tailwind at your back. As Sequoia Capital formalizes in their "Crucible" framework, true FMF gives you a "Right to Win" that is 10x to 100x stronger than your competitors. It's about finding the structural asymmetry where your specific assets—your network, your history, your psychology—create a gap that incumbents can't cross and new entrants can't replicate.

I wanted to share a deeper look at the frameworks I’ve been reviewing. It’s worth exploring these with your co-founders to see where your unfair advantages really lie.

1. What is your specific "Edge"?

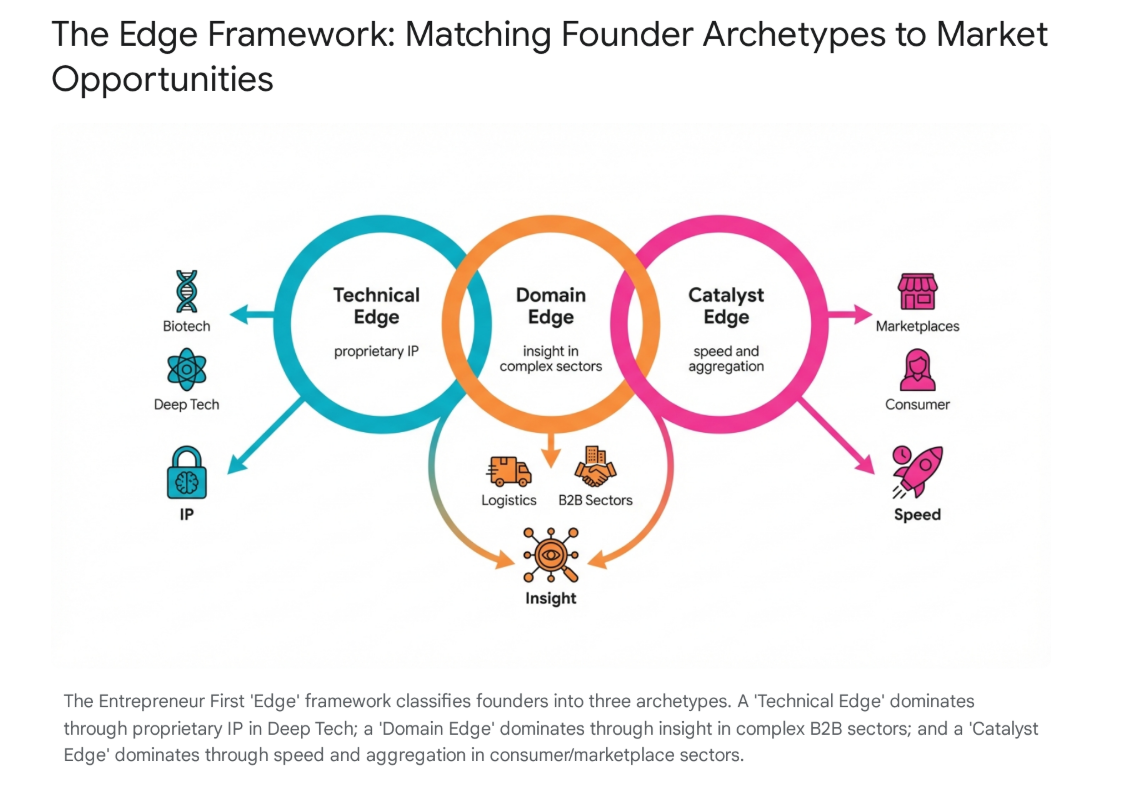

The team at Entrepreneur First (EF) has a rigorous way of breaking this down. They operate on the premise that the team is the unit of investability, not the idea. They argue you shouldn't just pick a "good idea" off a list. You should pick an idea that is "native" to you. They categorize this "Edge" into three distinct archetypes:

- The Domain Edge (The Insider): You’ve spent years immersed in a specific industry (like logistics, maritime, or healthcare). You know "where the bodies are buried"—why previous attempts failed, how complex procurement works, and the unwritten rules of regulation. You have "earned secrets" and information asymmetry that outsiders can't just Google.

- The Trap: Be careful of "vertical lock-in." Sometimes insiders are too indoctrinated to see radical change, building "vitamins" (small improvements) rather than "painkillers."

- The Technical Edge (The Specialist): You can build something 99% of people can’t. Think of a PhD working on the frontier of computer vision or mRNA synthesis. Your advantage is proprietary IP and R&D capability.

- The Strategy: For you, the question isn't "What is a cool product?" but "Where is this specific technology the biggest bottleneck?" You are looking for a problem that only your tech can solve.

- The Catalyst Edge (The Generalist): You might not be the deep researcher or the industry veteran, but you are a "high agency" individual. You excel at aggressive execution, sales, storytelling, and rallying resources. You are the "activator" who turns a static technology into a dynamic business.

- The Role: You are often the necessary counterweight to a technical co-founder, handling the "cold start" problem in marketplaces or consumer apps where speed is the primary moat.

The takeaway: If you are a Technical Specialist, don't try to start a heavy operations company. If you are an Insider, don't try to build a consumer social app for teens. Stay where your assets are strongest.

2. The "Saturday Morning" Test & Obsession

Erik Torenberg talks about the "Personal Moat," and NFX discusses the psychology of "Obsession." These are softer, but equally powerful checks on your long-term sustainability.

Ask yourself: What do I do on a Saturday morning for free?

If you read medical research papers for fun, you have a potential moat in biotech. If you organize community meetups because you enjoy it, you have a moat in community building. This is the activity that looks like work to others but feels like play to you.

This matters because startups are a grind that can last 7–10 years. "Obsession" isn't just passion; it's a compulsion. It acts as an infinite energy source. If you are relying solely on willpower and discipline, you will eventually burn out when competing against a founder for whom the work is intrinsically rewarding. You want to be in a market where your natural curiosity pulls you through the inevitable "trough of sorrow."

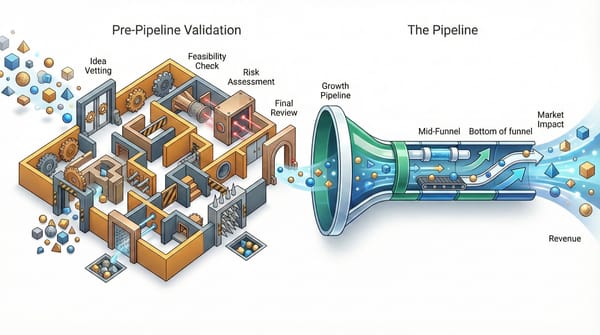

3. Have you mapped the "Maze"?

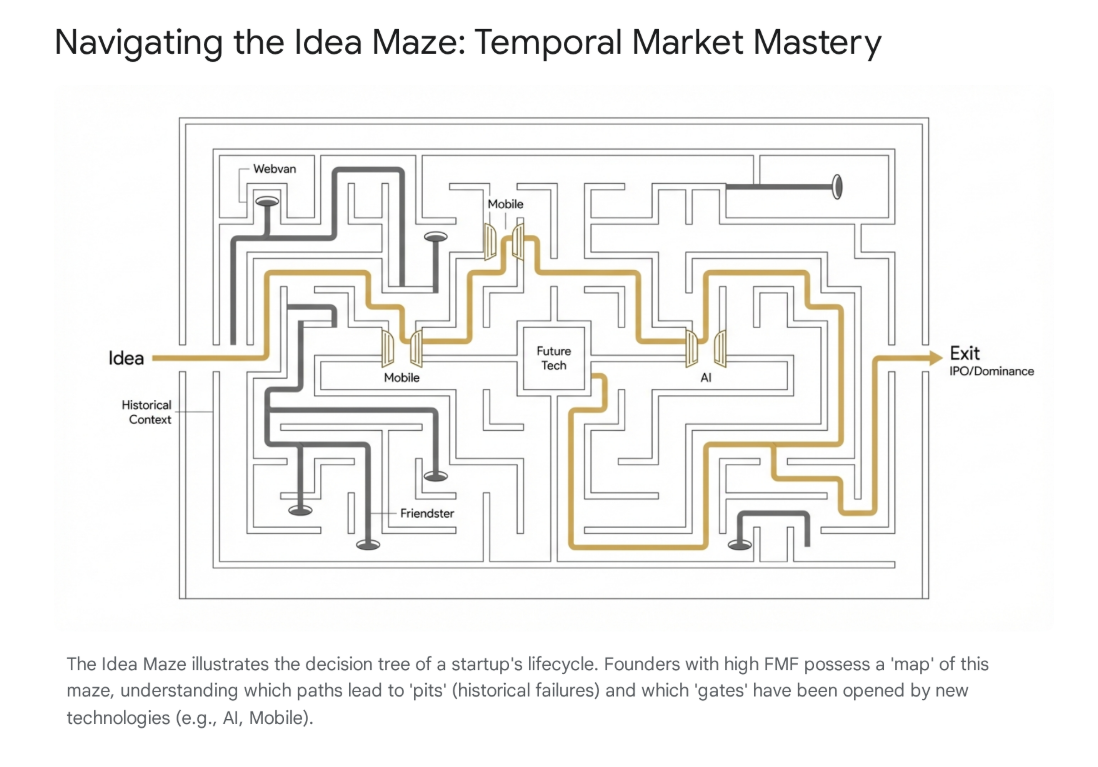

Balaji Srinivasan has a concept called the "Idea Maze." A founder with high FMF doesn't just have a snapshot of the market today; they have the entire "movie" of the market in their head.

To dominate the maze, you need to answer three levels of questions:

- Past (History): Do you know exactly why the last three startups in this space failed? Was it timing? Latency? Cultural readiness?

- Present (Technological Determinism): Why is now the right time? What underlying tech (e.g., GPS, AI latency, crypto infrastructure) has changed that opens a wall in the maze that was previously closed?

- Future (Branching Paths): If we choose Strategy A (go direct-to-consumer), can we anticipate the counter-moves incumbents will make? If we pivot to Enterprise, do we know the friction of those sales cycles?

If you are surprised by a competitor's move or a regulatory hurdle, you might be "lost in the maze." The best founders have simulated these scenarios years in advance.

4. The "Rich vs. King" Dilemma

One critical addition comes from Noam Wasserman’s research at Harvard. He highlights a trade-off that often kills FMF: the choice between Wealth and Control.

- The King Motivation: You prioritize retaining control of the board and decision-making. You are structurally "unfit" for capital-intensive markets (like building AI foundation models or ridesharing) that require massive funding and dilution.

- The Rich Motivation: You prioritize the financial value of the equity. You are willing to bring in VCs and perhaps even step aside as CEO if it means the pie gets bigger.

There is a lot of friction when a "Control" motivated founder tries to attack a "Winner-Take-All" market. The market’s capital requirements fight against the founder’s psychological needs. Be honest about which game you are playing.

Summary

The goal here isn't to discourage us from big ideas, but to direct us toward the battles we are most likely to win. Founder-Market Fit is about moving from "guessing" to "calculating" your advantage.

If you’re currently ideating or pivoting, take a moment to audit your team against these points. It might clarify why some things feel impossibly hard, while others feel natural.

Thanks for reading.

Troy